Doordash Net Worth: The Inside Scoop You Need To Know!

Doordash net worth has become one of the hottest topics in the business world today. The company’s rapid growth and expansion have turned heads, leaving many wondering just how much this food delivery giant is worth. If you’ve ever pondered the financial muscle behind Doordash, you’re in the right place. We’ll break it all down for you in a way that’s easy to digest—pun intended!

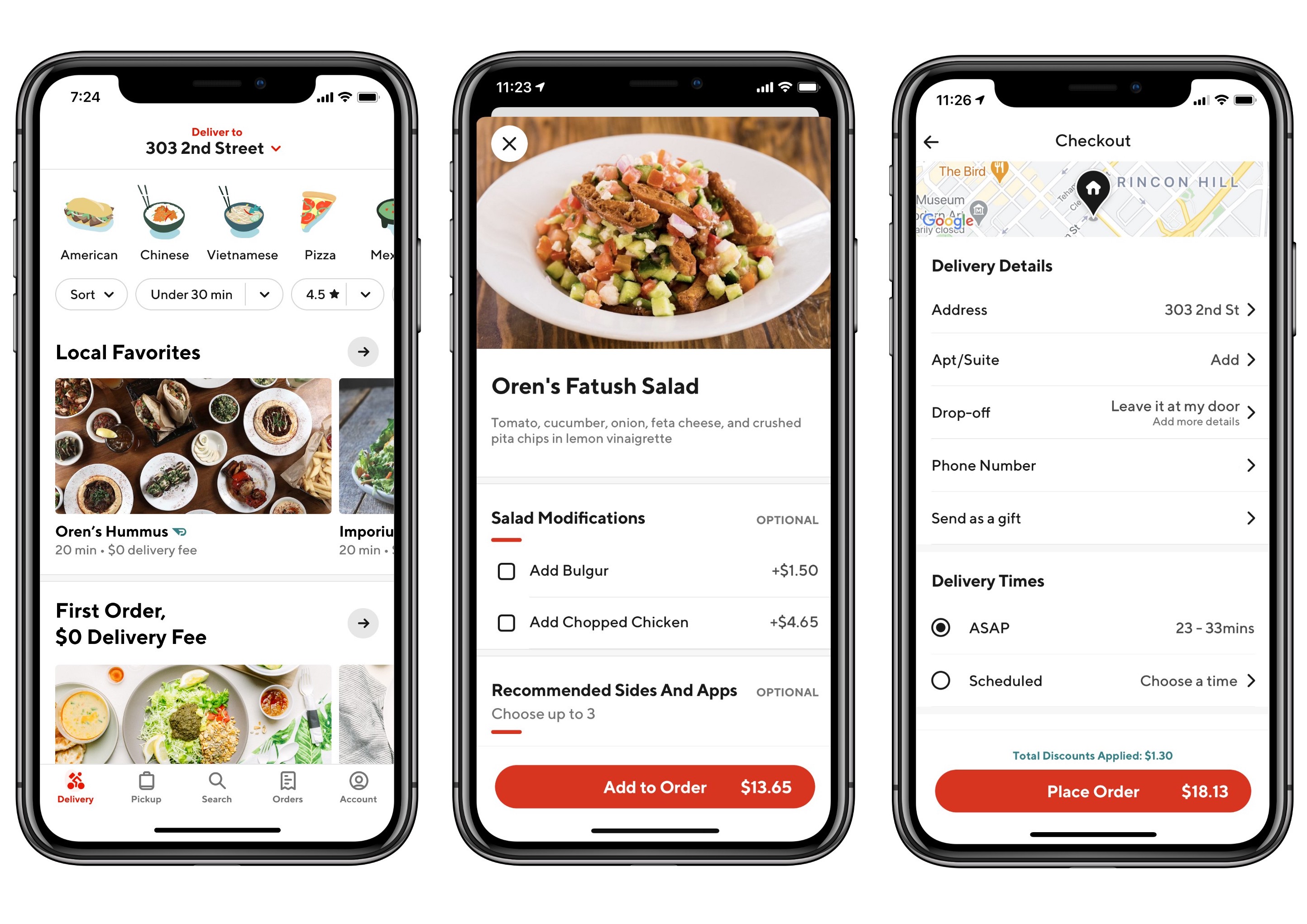

Picture this: a world where ordering food is as simple as tapping on your phone. That’s exactly what Doordash has brought to the table, revolutionizing the food delivery game. But with great success comes great curiosity. Investors, analysts, and even casual observers are dying to know the numbers behind the brand. In this article, we’ll dive deep into the financials, exploring what makes Doordash tick and how its net worth stacks up.

Now, before we get into the nitty-gritty, let’s set the stage. Doordash isn’t just another app—it’s a powerhouse that’s reshaping the food industry. From its humble beginnings to its current status as a market leader, the journey has been nothing short of impressive. So buckle up, because we’re about to uncover the secrets behind Doordash’s financial empire.

- Dj Adonis Net Worth The Untold Story Of A Legendary Djs Success

- Bill Jordan Net Worth The Untold Story Of Success And Wealth

Let’s kick things off with a table of contents to help you navigate this beast of an article. Feel free to jump around depending on what catches your interest!

The Origin Story: How Doordash Started

Doordash Net Worth: Breaking It Down

- Lacey Chabert Net Worth A Deep Dive Into The Career And Wealth Of A Hollywood Icon

- David Bromstad Net Worth The Inside Scoop On His Wealth Career And More

Revenue Streams: Where the Money Comes From

Market Position: Who’s Competing?

The IPO Journey: A Game-Changing Moment

Growth Metrics: How Fast Is Doordash Expanding?

Challenges Ahead: What Could Trip Them Up?

Investor Insights: Who’s Backing Doordash?

The Future: Where Is Doordash Headed?

Final Thoughts: What It All Means

The Origin Story: How Doordash Started

Every great story has a beginning, and Doordash’s tale is no exception. Founded in 2013 by Tony Xu, Stanley Tang, Evan Moore, and Andy Fang, Doordash was born out of a simple idea: make food delivery faster, easier, and more efficient. What started as a small operation quickly gained traction, thanks to a growing demand for convenience in the digital age.

In the early days, Doordash operated primarily in the Bay Area, focusing on building a reliable network of drivers and restaurant partners. The team’s dedication paid off, and soon they began expanding to other cities across the United States. By 2015, Doordash had already established itself as a major player in the food delivery space, setting the stage for its future success.

Key Milestones in Doordash’s Journey

- 2013: Doordash officially launches in Palo Alto, California.

- 2015: Expansion to major cities like New York, Chicago, and Los Angeles.

- 2017: Introduction of DashPass, a subscription service that offers free delivery.

- 2020: Historic IPO on the New York Stock Exchange.

These milestones highlight the rapid growth and strategic moves that have propelled Doordash to the top. But what does all this mean for their net worth? Let’s find out!

Doordash Net Worth: Breaking It Down

Alright, let’s get to the juicy part: Doordash’s net worth. As of 2023, Doordash’s market capitalization stands at an impressive $30 billion, making it one of the most valuable companies in the food delivery sector. But what exactly does this mean?

Market capitalization, or “market cap,” refers to the total value of a company’s outstanding shares. For Doordash, this figure represents the combined worth of all its publicly traded shares. While market cap gives us a good idea of a company’s size, it’s not the only metric to consider when evaluating net worth.

Other factors, such as revenue, profit margins, and cash reserves, also play a significant role. Doordash’s financial health is robust, thanks to its diverse revenue streams and strong market position. But how exactly does the money flow? Let’s take a closer look.

Revenue Streams: Where the Money Comes From

Doordash generates revenue through a variety of channels, each contributing to its overall success. Here’s a breakdown of the main sources of income:

1. Delivery Fees

One of the primary ways Doordash makes money is through delivery fees charged to customers. These fees vary depending on the distance, size of the order, and other factors. While some users opt for free delivery through DashPass, the majority still pay a small fee for each delivery.

2. Commission from Restaurants

Restaurants also contribute to Doordash’s revenue by paying a commission on each order. This commission can range from 15% to 30%, depending on the agreement between the restaurant and Doordash. It’s a win-win situation, as restaurants gain access to a wider audience while Doordash pockets a healthy profit.

3. DashPass Subscription

Introduced in 2017, DashPass has become a key revenue driver for Doordash. For a flat monthly fee, subscribers enjoy unlimited free deliveries, encouraging them to order more frequently. This subscription model provides a steady stream of recurring revenue, boosting Doordash’s financial stability.

With these revenue streams in place, Doordash has built a solid foundation for growth. But how does it stack up against its competitors? Let’s find out.

Market Position: Who’s Competing?

The food delivery industry is fiercely competitive, with several big players vying for market share. Doordash’s main rivals include Uber Eats, Grubhub, and Postmates. Each of these companies offers similar services, making the competition intense.

Despite the competition, Doordash holds a commanding lead in the U.S. market, capturing around 50% of the total share. This dominance can be attributed to its innovative approach, extensive network of drivers, and strong partnerships with top restaurants. However, the battle isn’t over yet, as competitors continue to invest in technology and expand their offerings.

Comparing Market Shares

- Doordash: 50%

- Uber Eats: 30%

- Grubhub: 15%

- Postmates: 5%

These numbers paint a clear picture of Doordash’s leadership position. But how did they manage to achieve such success? The answer lies in their IPO journey.

The IPO Journey: A Game-Changing Moment

Doordash’s initial public offering (IPO) in December 2020 was a landmark event that solidified its place in the business world. The company raised $3.4 billion in the IPO, with shares priced at $102 each. On the first day of trading, the stock soared to $189.51, valuing the company at over $50 billion.

This IPO was a game-changer for Doordash, providing the capital needed to fuel further growth and innovation. It also attracted a wave of new investors, eager to capitalize on the company’s potential. But the road to IPO wasn’t without its challenges.

In the lead-up to the IPO, Doordash faced scrutiny over its business model, particularly concerning driver pay and working conditions. To address these concerns, the company implemented several measures to improve driver compensation and benefits. These efforts helped build trust with both investors and the public.

Growth Metrics: How Fast Is Doordash Expanding?

Doordash’s growth has been nothing short of phenomenal. From its humble beginnings in 2013, the company has expanded to serve over 4,000 cities across the United States, Canada, and Australia. This rapid expansion has been driven by a combination of organic growth and strategic acquisitions.

One of the key drivers of Doordash’s growth is its focus on technology. The company has invested heavily in developing advanced algorithms that optimize delivery routes, reduce wait times, and improve the overall customer experience. These innovations have set Doordash apart from its competitors, enabling it to deliver faster and more efficiently.

Another factor contributing to Doordash’s growth is its expanding network of restaurant partners. With over 300,000 restaurants on its platform, Doordash offers customers a wide variety of options, from local eateries to national chains. This diversity has helped attract a loyal customer base, driving repeat business and boosting revenue.

Challenges Ahead: What Could Trip Them Up?

Despite its success, Doordash isn’t immune to challenges. The company faces several obstacles that could impact its future growth and profitability. Here are some of the key challenges:

1. Rising Competition

As mentioned earlier, the food delivery market is highly competitive. With new players entering the scene and established competitors ramping up their efforts, Doordash must continue to innovate to maintain its edge.

2. Regulatory Pressures

Doordash operates in a highly regulated environment, with laws and regulations governing everything from driver pay to food safety. Navigating these regulations requires constant attention and adaptation, which can be costly and time-consuming.

3. Economic Uncertainty

Like all businesses, Doordash is susceptible to economic fluctuations. A downturn in the economy could lead to reduced consumer spending, impacting the company’s revenue. To mitigate this risk, Doordash must diversify its offerings and explore new revenue streams.

While these challenges are significant, Doordash has proven time and again that it has what it takes to overcome them. But what about the people behind the scenes? Let’s take a look at the investors who have backed Doordash’s success.

Investor Insights: Who’s Backing Doordash?

Doordash’s journey wouldn’t have been possible without the support of its investors. Some of the biggest names in venture capital have poured money into the company, recognizing its potential for growth. Here are a few of the key investors:

- Sequoia Capital

- SoftBank Vision Fund

- Kleiner Perkins

- GGV Capital

These investors have not only provided financial backing but also strategic guidance, helping Doordash navigate the complexities of the food delivery industry. Their continued support is crucial for the company’s long-term success.

The Future: Where Is Doordash Headed?

Looking ahead, Doordash has ambitious plans for the future. The company aims to expand its reach beyond food delivery, exploring new markets and services. One area of interest is grocery delivery, where Doordash has already made inroads through partnerships with major retailers.

Another focus is on sustainability. Doordash is committed to reducing its environmental impact, investing in eco-friendly packaging and promoting sustainable practices among its restaurant partners. These efforts align with growing consumer demand for environmentally responsible businesses.

With its strong financial position, innovative mindset, and dedicated team, Doordash is well-positioned to thrive in the years to come. But what does all this mean for you, the reader? Let’s wrap things up with some final thoughts.

Final Thoughts: What It All Means

In conclusion, Doordash’s net worth is a testament to its success and potential. From its humble beginnings to its current status as a market leader, the company has demonstrated remarkable growth and resilience. By understanding the factors that contribute to its financial success, you can appreciate the scale of its achievements.

So, whether you’re an investor looking for opportunities or a customer enjoying the convenience of food delivery, Doordash has something to offer. We encourage you to share this article with your friends and explore more content on our site. Together, let’s stay informed and inspired by the world of business and technology!

- Mike Ness Net Worth The Untold Story Of A Rock N Roll Legend

- Victory Brinker Net Worth A Closer Look At Her Journey Lifestyle And Financial Success

DoorDash Logo LogoDix

Doordash Help

Doordash Worth It 2024 Jeana Lorelei